The information in this blog post may now be out of date. See how to tax your vehicle.

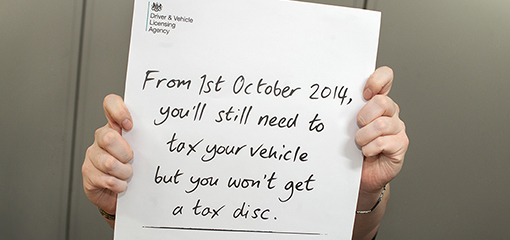

From 1 October 2014, the paper tax disc will no longer need to be displayed on a vehicle windscreen.

To drive or keep a vehicle on the road you will still need to get vehicle tax and DVLA will continue to send you a renewal reminder when your vehicle tax is due to expire.

You can apply online to tax your vehicle using the16 digit reference number from your vehicle tax renewal reminder (V11) or 11 digit reference number from your log book (V5C).

Renew online

DVLA has been hard at work to make renewing your tax disc online a simpler, clearer and faster process.

At the end of February, they launched a public beta version of the Renew a tax disc service.

Beta means that the service is not completely finished but it will still do everything it’s designed to do. The beta service is available at the same time as the existing service and you can choose which one to use. Beta services are designed to be easier to use than the services they replace.

Now, beta has entered a new phase as DVLA prepares for it to become the main way to pay for Vehicle Excise Duty (the official name for the tax disc).They’ve already started to see an increase in users and will be monitoring how well the beta service performs.

Use the beta service to renew your vehicle tax, and your experience will help DVLA to make this system simpler, clearer and faster to use.

Find out the latest from DVLA on vehicle tax changes.

If you have a question about vehicle tax, contact DVLA directly.

61 comments

Comment by Sally Cridland posted on

Very quick and efficient also so very easy

Comment by Bradley Woods posted on

Just taxed my car for 12 months using direct debit, great idea since I won't have to worry about it anymore. The 5% charge is not to bad, but I need to contact dvla now as they have charged me 50%....

Comment by Stan posted on

The old system for taxing a vehicle online was very good, quick, easy to use and one of the best we sites I have used.

The new "beta" system will not accept card payments!! and I did not want to use direct debit as I am not in control and it will be me that looses the car!

So I tried the telephone, it is now an automated system, no thank you!

This is not an improvement

Comment by Freddie posted on

Right, this is one major problem. I bought a vehicle recently, having seen the tear-off portion of the V5, but the owner had just bought the vehicle himself and sent the main document off so he could be recorded as the new owner. Now I have to wait for the document to be returned to him, so I can then register the document in MY name, before I can buy tax. Before this debacle, if a vehicle was taxed, you could use it while the V5 was being updated. This new method means I have to wait for the V5 to come back to the previous owner, which means I am off the road until then. If I use the tear-off portion of the previous owner's V5 to get tax, DVLA are likely to cancel it and refund the money to HIM once I update the V5 with MY details. Thanks DVLA

Comment by ron posted on

This system is not fit for purpose. being disabled i have to now go to my local PO inorder to retax my vehicle, the online system simply cannot match my certificate DLA404 to my car! Even though the vehicle has been taxed for the previous year for the first time using the same certificate at the P.O , so now i have to go to my local P.O again, even though according to the beta service it should be straightforward to do online. im sorry this is no good to me as a disabled person it doesnt help me whatsoever.

Comment by Daryl Swann posted on

Well at first I thought great - but - as usual lol

I go through the easy (good) set up direct debit arrangement to find (oh no) I can't apply this way as I'm not the only person authorised to arrange (& I'm presuming cancel is the real issue??) direct debits......are you guys for real??

Amazing as a couple we can easily pay for everything else by direct debit - except for the car tax

Absolutely ridiculous - if this was a private company someone would be sacked for not allowing a perfectly valid income stream to be processed... local council tax & all utilities etc etc are on Direct Debits & none of those providers have ever been this petty...

Comment by alan posted on

Why when i put my registration certificate document reference number in , it keeps saying vehicle unrecognised ?

Comment by Jacqueline posted on

Hi I purchased a car from a dealership about 3 weeks ago the new log book hasn't arrived yet and tax is due tomorrow. Will be renewing with disability tax. How do I apply without log book? Thanks

Comment by skyler posted on

I cant renew my car tax either it wont work and im going away soon frightened of a fine ... what do i do now ive only just got the document as i swoped my car and it took the dvla 2 weeks to return the correct forms.

Comment by KEVIN TUCKER posted on

IF YOU BUY A CAR TODAY HOW DO YOU GO ABOUT DRIVING IT THE SAME DAY. IF IT HAS NO TAX ON IT, WHO DO YOU CONTACT OR HOW DO YOU PAY IT .

Comment by Moira Scothern posted on

https://emaildvla.direct.gov.uk/emaildvla/cegemail/dvla/en/index.html

This is a joke...

It appears the link is broken. Would have liked to have renewed my car tax today, but a simple task which should be able on line becomes a task and a half,

How come Amazon and similar don't have this problem...???

Comment by Moving On posted on

Many thanks for all your comments on this page.

We have been in touch with DVLA about their web pages, and they have responded: "We can confirm that the unprecedented demand for car tax online temporarily affected the services provided by Vodafone to DVLA. Vodafone's engineers worked hard with us to resolve the issue as quickly as possible and the service has now been restored. Vodafone will continue to monitor the service closely and will be carrying out a full investigation into the issue.”

DVLA continues to update their web page with the latest information on vehicle tax changes: http://www.gov.uk/government/news/vehicle-tax-changes

If you still have questions about vehicle tax, you can contact DVLA directly through their website: https://emaildvla.direct.gov.uk/emaildvla/cegemail/dvla/en/index.html

Comment by Nikki posted on

If these changes are bringing in a yearly 10 million pound admin saving for the DVLA, will this result in job losses (in post offices, DVLA), and will these savings be passed onto the drivers resulting in lower road tax costs, or do these savings pay to fund the 1000's of ANPR software equipment that will be required to enforce road tax evasion. Is it time to buy shares in APNR equipment. I doubt as a driver I will benefit from any of this.

Comment by wil posted on

The links to apply for road tax don't work why is that

Comment by Susannah posted on

been trying to renew online for two days but websites (Yes both) are down!!!!

Comment by carla posted on

I have been trying to renew my tax all evening yet your website is not allowing me to also your phone lines are saying maintainers problems my tax runs out tonight what am I going to do I have work at 6am..none of your renew sites are working.

Comment by lynne fawcett posted on

Have tried to renew on Lind and by phone today, website is down and telephone service I'd down for essential maintenance. What can I do, can I renew tomorrow 1st october

Comment by Trudy posted on

if you change your car and are applying for new tax and you are eligible for free tax because you are on the DLA how do you prove this if you cant go to the main office anymore?

Comment by Rigs posted on

Can you advise, how does the seller instantly inform DVLA on a Sunday afternoon that they have sold a vehicle, so that the buyer (the new keeper)can instantly apply for road tax before they can move the vehicle. Could you also advise if the Insurance Company's will be supporting this new system by being available 24/7. The issue here is a person might drive 200 miles to purchase a used vehicle and could possibly be forced to make the journey a second time to collect the taxed vehicle.

Comment by lico9182 posted on

Yes, but you could allow the keeper/owner to use only there vehicle registration as reference to renew a tax disc, as, during the current online renewal process the system confirms the correct vehicle to you (what the vehicle is), you would only need an additional bit of reference, say like adding the last 4 digits of card payment used from the previous renewal payment you made.

As there's still no guarantee that using the reminder reference, or the vehicle registration log book reference, could for certain be an endorsement that what you entered was correct for you car, you could still enter incorrectly a single digit not paying attention that the vehicle was not yours, but following through to it's payment (it's easy to click 'Next' then 'Next' being to quick, or in a panic to purchase, and careless)

Also, generally people are more positive about there vehicle registration numbers in much the same way as they are with there bank card pins, so less likely to get this number wrong.

I would say notion of needing a renewal notice reference, or vehicle registration doc reference is floored, these references should be a 2nd and 3rd option when not knowing the 1st and obvious option 'the cars number plate'

It's only taken about 70 years (really the last 20 digital age years)for the paper car tax to come to an end, let's hope it doesn't take another 20 years to be able to pay for car tax just using a number plate (just think no sending out reminders for one thing, the sheet of paper a lot bigger than a tax disc ever was)

Comment by Ronnie posted on

If you are a car dealer and currently have a tax disc valid on a car is it still valid also we dnt register cars on our names so we dnt put extra ownership on the vehicle what do we do

Comment by Ronnie posted on

If you are a car dealer and currently have a tax disc valid on a car is it still valid or what

Comment by CJ posted on

Do I have to renew for 6 or 12 months, is there an option to renew for 3 months? Seems unfair not to...

Comment by John posted on

Same as some above ...Do we have to display existing tax discs until they run out?

Comment by Jim M posted on

I am going away on holiday for over two weeks, not returning until just into October - will I be able to renew my car Tax before I go away - even tough I wont have had the reminder - as it'll certainly be out of date by the time I get back to the UK?

Comment by Andy posted on

If you are disabled class and don't pay any way what happens then please?

Thank you

Comment by Moving On posted on

Many thanks to everyone who has read, commented and sent questions in about this blog post.

DVLA has added to their online advice at http://www.gov.uk/government/news/vehicle-tax-changes to explain what happens to paper discs on 1 October, how to set up a Direct Debit to pay for vehicle tax and what happens to vehicle tax when you buy or sell a vehicle. This answers the more frequently asked questions you've sent in.

For more unusal questions and to help you find out all about this change, DVLA will also be hosting a webchat on 3 September 2014 at 10am about the changes to vehicle tax.

Join the chat at 10am on 3 September http://assets.dft.gov.uk/web-chats/vehicle-tax-changes

Comment by Big Sean posted on

i have a tax disc that expires at end of feb 2015 what do i do about it? do i display it? do i send it back

Comment by Rachel posted on

My tax runs out end of November do I keep my tax disc in my car. Will this only affect me when I come to renew my tax?

Comment by Marco posted on

I know a small time car dealer who doesn't have a main car but uses whatever car that is taxed, until it sells, then uses another one etc, etc all are insured through his trade insurance and correct trade part of v5 filled in so nothing dodgy. Does that mean he must tax every one of the cars he sells in a month which may amount to ten cars or more ? Registering every one to remote tax? Paying a min one months road tax then maybe owning the car for less than a week? Add that up ten times, he will be bust in a month? Trade plates are not the answer as they have so many limitations ie can't carry passengers, can't be left unattended etc etc, I can't believe that there has been no major information available so close to the switch over time?

Comment by J Platten posted on

This business of removing tax discs from windscreens on 1st October 2014 seams crazy to me, more people will be driving around on false number plates and not taxing there vehicles! This is already happening now and will increase!!

Comment by Jessie, DVSA posted on

DVLA has added to their online advice at http://www.gov.uk/government/news/vehicle-tax-changes to explain what happens to paper discs on 1 October, how to set up a Direct Debit to pay for vehicle tax and what happens to vehicle tax when you buy or sell a vehicle.

Comment by SJB posted on

This may sound stupid, but my existing tax disc (which runs out in March 2015) is still valid and can still be displayed? This only applies for when I apply for the next tax disc?

Comment by Brian posted on

I have just renewed my road tax and got a disc through , I take it this will be valid until I have to renew the next time?

Comment by dannielle posted on

Hello, I just taxed my car in July what will happen when we reach October. Can we get a refund or still kee the disc in the car window until next renewal.

Comment by Mr Rowe posted on

Why have road tax anyway ? Why not add the cost to fuel ? The more you use, the more you pay. All fair all round in my opinion.

Comment by Ian posted on

The old saying springs to mind - If it aint broke dont fix it

As per usual another over compicated system being forced upon us.......

Comment by Shari posted on

Hi

sounds good, but will the DVLA be changing the V317 regarding the tax disc serial number and date as a motor trader how would we get this information and how update will this be?

Comment by DVLA digital comms team posted on

Yes, the V317 form will be changed to take into account that there will no longer be a tax disc available.

Comment by john posted on

why exactly is it progress to not be able to tell at a glance if a vehicle is taxed and can therefore be driven legaly by the motor trade ect ?. presumably this is a money saving excersize !

Comment by DVLA digital comms team posted on

This is a red tape challenge exercise and will save the taxpayer around £10million each year.

Comment by david bradley posted on

there is no saving at all to the tax payer its just another way of stealth tax think about it you can only clame full months tax back and if you bye your new car mid month you have to pay from the first of the month so so think how many cars are taxed twice in the same month times cars sold mid month in the uk also as its ANPR 2 + cars in the same part of the uk that look the same same plates and looking the same only need tax one the way it looks to me if its not broken don't change it

Comment by Angus Mctaggart posted on

Hi great idea but worried if our vehicles are stopped by the DVSA or the Police, I asume they

will have onboard computers to access any information required, is this correct as my Dirvers

are concerned that they could be held responsible, and I am assuming this will also apply to cars and motorcycles, but i believe this is a great idea resulting in less administration?

Angus

Comment by Jessie posted on

Hi Angus,

DVLA says: Yes, we are working closely with local enforcement agencies, the police and local authorities who currently use ANPR technology within their vehicles to identify if a vehicle is taxed.

Jessie, DVSA

Comment by Mrs knight posted on

I have taxed my car, and I need tax disc in time for holiday car parking as they have said even though I've taxed vehicle it must have paper disc on screen , is there any way of getting it any quicker?

Mrs knight.

Comment by Jessie posted on

Hello Mrs Knight,

DVLA says: The tax disc is normally received within 3-5 working days, however it does arrive quicker than this a lot of the time. If you taxed your vehicle before the previous disc expired then you can use the vehicle on the road for up to 14 days.

Jessie, DVSA

Comment by Mark posted on

On a drivers walk around check PSV we check the road tax disc to check to see its valid . But with the new rules coming how do we no the vehicle we are going to drive has road tax.

Comment by jim young posted on

Hi. Some of us live in a rural area where the broadband is non existent at times. Will we still be able to tax our vehicles at the post office as we do at present?

Comment by Jessie posted on

Hi Jim,

DVLA says: Yes, The Post Office services will remain. However, the vehicle should not be used until valid vehicle tax has been taken out.

Jessie, DVSA

Comment by Driver Dave posted on

A suggestion: why not simplify it even further by removing the requirement to enter the reminder number or logbook number? Vehicle details can be checked just using registration number, so why shouldn't we be able to just go online, enter registration number, pay and be done with it?

The system doesn't require the registered keeper to pay for it - anyone's card is accepted. And the tax disc (for now) is sent to the registered keeper without their details being shown in the transaction. So it can't be a security issue.

The new service is a nice design update to the old one - so I don't want to sound too critical. But this seems like a small missed opportunity to make a highly used service even easier online.

Comment by Jessie posted on

Hi Dave,

DVLA says: The reference number check from the logbook and tax reminders are in place to make sure the correct vehicles are taxed or SORNed as an incorrect registration number could be input when making the transaction.

Jessie, DVSA

Comment by Andy posted on

This is more problems for the motor trade , having to check vehicle are taxed all the time .

Also I have been told that if somebody sells their car ,they have to surrender the tax disc and the next owner will have to tax it..what happens when we have no internet , which happen in our area a lot . You closed down all the local DVLA centres. We pay for these services through fuel duty and road fund licenses. Some people don't have the internet.

Comment by Jessie posted on

Hi Andy,

DVLA says that to use a vehicle, new keepers must always obtain new vehicle tax when taking possession of the vehicle.

DVLA always advise that vehicles are not purchased without sight of the Vehicle Registration Certificate (V5C). Any person buying a vehicle should insist on the new keeper supplement (V5C/2) which allows the buyer to obtain a new vehicle tax immediately. The V5C/2 can be used at a Post Office branch and DVLA will develop the existing electronic channel for new keepers to tax a vehicle at the point of purchase, either by phone or online.

Jessie, DVSA

Comment by les howard ( howard motors) posted on

hi i work in a garage how do i no if a car is taxed when i go out on a test drive to listen to faults etc

if the vehicle is not taxed who gets the points and the fine me or the owner,

Comment by Jessie posted on

Hi Les,

You can check the tax status of any vehicle online.

This can also be used for rental vehicles. The police also now have easy access to DVLA’s vehicle register including Automatic Number Plate Recognition (ANPR) system to help to enforce non-payment of vehicle tax.

Comment by Lance Fogg posted on

If there is no tax disc visible, how will we, the police and local authorities know whether a car is taxed and insured. I am a Neighbourhood Watch coordinator and dumped vehicles are one of the problems in parts of the town. The absence of a tax disc will just complicate an otherwise working system

Comment by Jessie posted on

Hello Lance,

You can check the tax status of any vehicle online.

This can also be used for rental vehicles. The police also now have easy access to DVLA’s vehicle register including Automatic Number Plate Recognition (ANPR) system to help to enforce non-payment of vehicle tax.

Abolition of the tax disc will provide DVLA with administrative cost savings and provide annual savings of around £10 million to the taxpayer as a result of no longer producing, issuing and posting the tax disc. In addition it will remove an administrative inconvenience for millions of motorists.

Jessie, DVSA

Comment by Marita Burkimsher posted on

Will it be possible to pay for stamps direct to DVLA weekly or monthly instead of having to pay all in one go when tax becomes due ?

Comment by Jessie posted on

Hi Marita,

Although we've posted this message on our web pages, DVLA is responsible for dealing with vehicle tax - so you would need to email your question to DVLA for a full response.

Cheers,

Jessie, DVSA

Comment by karen beresford posted on

I need to tax my car at the end of September what documents do i need to do this and can I pay for 6 months

Comment by mark scanlon posted on

This is a good site, well done.