On 1 January 2016, revised financial standing levels for standard national and international operator licence applications and continuations came into force.

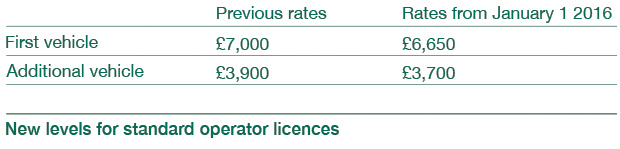

This means that when you submit an application for extra vehicles, or if you have to get a new licence, you’ll be asked to show financial evidence at the new reduced rates:

No change to the rates of finance needed to support a restricted licence

There will be no change to the rates of finance needed to support a restricted licence. This will remain at £3,100 for the first vehicle and £1,700 for each additional authorised vehicle.

Further guidance is available in the Senior Traffic Commissioner’s Statutory Guidance document on finance.

Image courtesy of Shutterstock.com

3 comments

Comment by R Slater posted on

Replying to Michael Hazell, Bank statements do not necessarily show financial standing. What is required is, access to funds to maintain the vehicles. This can be for example the amount of credit available on a credit card. A sole trader for could have personal finance i.e. not related to his business, should it be called upon to repair his vehicle.

Ray Slater. 22-9-16

Comment by Chris Walsh posted on

Why does it cost less to operate and maintain a vehicle on a restricted licence as a standard one?Same vehicle same maintainence requirement. An own account operator can be engaged on deliveries across the country just the same as a hire and reward operator. This is just another example of how hauliers are discriminated against.